Introduction:

Traditional electronic payment systems using internet, solely relies on third-party financial institutions. The fundamental flaw of these electronic systems is that they are trust based models. Bitcoin emerged as a ground-breaking solution to this shortcoming. Bitcoin is an electronic payment system built on cryptographic proof rather than trust, enabling direct transactions between willing parties without the need for a central authority. The core of Bitcoin’s operations lies in a blockchain, which forms the foundation of Bitcoin and many other cryptocurrencies. Blockchain is a decentralized ledger system which functions based on the process of mining, a crucial mechanism that ensures the integrity and security of the network.

Blockchain overview

Blockchain is essentially a distributed ledger system which registers all the transactions happening in a network of computers. Each transaction is categorised into blocks where each block is cryptographically encrypted using SHA-256 hashing algorithm. This hash is used to link a subsequent block to the previous one, creating a series of blocks that are chained together. This decentralized and unalterable ledger ensures transparency, security, and trust among participants.

The below figure shows the basic functioning of blockchain mining.

Significance of Mining

To buy or sell a Bitcoin (BTC), transactions occurring in the network needs to be verified. This is where “bitcoin mining” comes in. Mining is the process of creating new Bitcoins and incorporating the transactions into the blockchain. Miners use a strong computing system to tally the transactions and solve sophisticated arithmetic problems to reveal a new block in the chain. After a new block is revealed, the transactions incorporated in the block are verified and recorded on the public ledger. Miners compete to solve these problems, allowing them to create a new block and receive a reward in the form of Bitcoins. On January 3, 2009, the first Bitcoin block, known as Block 0, was mined, commencing the revolution of digital currency. Mining provides security and integrity to the Bitcoin network along with incentives to the miners.

Transaction Verification

The main aim of mining is verifying blockchain transactions. When a bitcoin transaction is commenced, it is broadcasted into the network which are collected into a pool for verification. Miners group these transactions and solves a mathematical puzzle known as the Proof of Work (PoW). PoW is based on a specific value (nonce) which is hashed along with block data to create another value that meets the predefined requirements. This transaction verification process is made to ensure that only valid transactions are incorporated into the blockchain, which prohibits duplicate transactions and fraudulent activities.

Decentralization

The main characteristics of Bitcoin is its decentralized nature which sets it apart from traditional financial systems. In conventional systems, the transactions are supervised using a central authority, such as a bank or any government institution. These centralised systems can be vulnerable to corruption and payment uncertainties. On the other-hand, Bitcoin is implemented on decentralized network nodes in such a way that none of the single entities has authority over the network. Decentralization provides security over fraud, manipulations, other malicious activities and transparency to financial transaction occurring in the network.

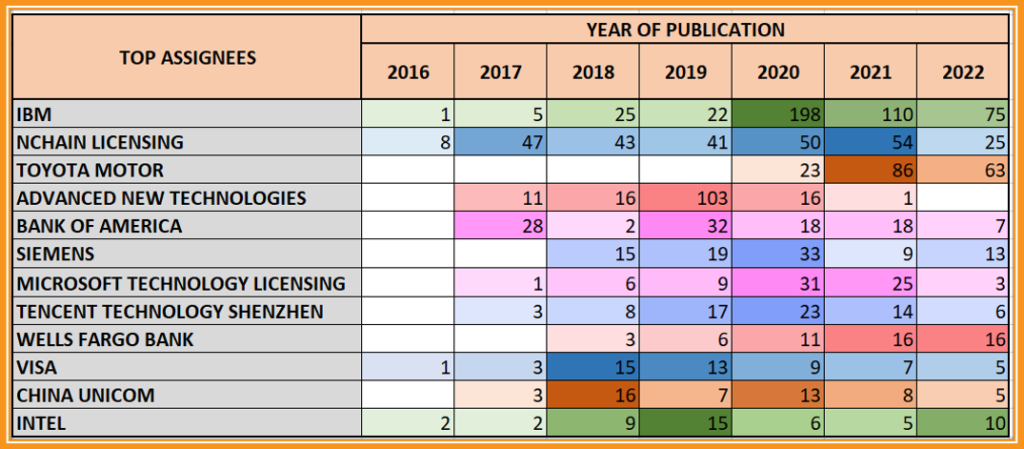

According to the intellectual property (patent) data, most patent publications have been observed since 2016, which shows the significance of blockchain technology in the current financial landscape. Top companies involved are IBM, Nchain Licensing, Toyota Motors, Bank of America, Tencent Technology, Siemens, Microsoft etc. Below chart shows top companies and their year wise patent publications in the cryptography domain.

Challenges in Bitcoin

Bitcoin has brought a drastic change in the world of finance, but has many challenges such as

Scalability Issues:

Blockchain networks have limitation on the count of transactions they can process at a time. When compared to major payment methods like Visa which can handle thousands of transactions per second, scalability of blockchain networks needs to be dramatically improved.

Implementation Costs:

Due to extensive upgrade requirement of manpower and infrastructure, companies need to make a large initial investment to implement blockchain technology.

Interoperability Challenges:

Due to lack of common protocols and standards, interoperability of blockchain systems is affected which makes it difficult for various blockchain systems and networks to communicate or share data with one another.

Energy Consumption:

The computational requirements for Bitcoin mining is substantially high which leads to increased energy consumption. As a result of this, concerns have arisen regarding the bitcoin industry’s environmental impact.

Regulatory Uncertainty:

Blockchain and cryptocurrency-related government policies remains unclear or, in some cases, non-existent, which makes businesses cautious to invest in and adopt blockchain technology.

Future Developments

The future of Bitcoin and blockchain technology has huge potential for innovation and expansion. Current researches are focused on addressing current challenges and exploring new areas for possible improvements. Layer 2 solutions like the Lightning Network is used to improve transaction scalability and speed, integration of smart contracts and decentralized finance (DeFi) is expanding as a potential application of blockchain. Additionally, progress is made in the field of consensus operations used in blockchain, such as Proof of Stake, for reducing energy consumption without compromising security.

In conclusion, the financial industry has been completely transformed by Bitcoin and blockchain mining, which provide a decentralised and trustworthy electronic payment system. Despite its challenges, ongoing developments promise to enhance and broaden the capabilities of blockchain technology, paving way for a more inclusive and efficient financial environment.

How can MCRPL help?

MCRPL’s innovative integration of AI and human expertise (MCRANK) offers a distinct edge in the field of patent searches. This synergistic approach not only ensures efficiency and accuracy but also taps into the nuanced understanding that human experts bring to the table. By harnessing the power of cutting-edge AI tools alongside seasoned professionals, MCRPL delivers comprehensive, precise, and timely results for its clients. This unique blend of technology and expertise is assured to revolutionize the patent search process, making MCRPL a trusted partner for businesses and innovators seeking to safeguard their intellectual property and drive forward in an increasingly competitive market.

With plenty of experience of working on Blockchain and cryptocurrency industries, MCRPL can bring out actionable intelligence and can also forecast the roadmap for Bitcoin/ Blockchain industry in the coming future. MCRPL has the right talent and expertise on the subject matter as well as on technical knowhow to quench your thirst in the R&D space.

© Molecular Connections Private Limited

For more information, contact priorart@molecularconnections.com

For more updates subscribe IP Tech Insider